Silent

Silent provides the tools for seekers to recognize their path and enables self-reliance for spiritual and magickal growth.

Seekers gain insight from his work and find their inner calm from his ability to listen and help others reflect.

There is a quiet phrase circulating in boardrooms, policy circles, and payer strategy decks right now: “We’re modeling it.”

Modeling coverage.

Modeling demand.

Modeling risk.

But modeling is not commitment. And in healthcare, especially where emerging modalities and non-traditional interventions are concerned, modeling is often a euphemism for delay.

In 2025, insurers and health systems are actively modeling. In 2026, they will be forced to decide.

That year will be the pressure test.

Why Insurers Are Hesitating

Insurers are not villains in this story. Their caution is, in many ways, rational.

First, risk exposure remains undefined. Without standardized protocols, insurers cannot reliably price risk. Variability in practice creates variability in outcomes—and variability is the enemy of actuarial confidence.

Second, training and competency gaps are real. When interventions depend heavily on practitioner skill, supervision, and judgment, the absence of formalized credentialing makes it impossible to separate qualified care from well-intentioned improvisation.

Third, outcomes uncertainty persists. Anecdotal success does not translate into population-level confidence. Insurers need repeatable, measurable, and comparable data. Without it, coverage becomes a bet, not a strategy.

So insurers model. They watch. They wait.

And that waiting creates a vacuum.

What 2026 Must Deliver to Move the Needle

If 2026 is going to be the year coverage decisions move from theory to practice, several non-negotiables must be in place.

1. Standardized Protocols

Not rigid scripts—but clear, documented standards of care. Protocols that define scope, boundaries, escalation paths, and contraindications. Without these, insurers cannot distinguish responsible practice from reckless expansion.

2. Credentialing and Supervision

Coverage requires accountability. That means credentialing bodies, defined training pathways, continuing education, and supervision requirements. Not self-attestation. Not social proof. Formal structures that insurers can trust.

3. Adverse Event Reporting

If something goes wrong—and eventually, something will—there must be a transparent, non-punitive reporting mechanism. Healthcare advances when failures are studied, not hidden. Insurers will not step in unless they believe the system can self-correct.

4. Measurable Outcomes

Not vibes. Not testimonials. Data. Outcomes that matter to patients, providers, and payers alike: reduced utilization, improved quality-of-life metrics, lower downstream costs, and longitudinal impact. If it can’t be measured, it can’t be covered.

These are not bureaucratic hurdles. They are the cost of legitimacy.

The Real Danger: Coverage Without Standards

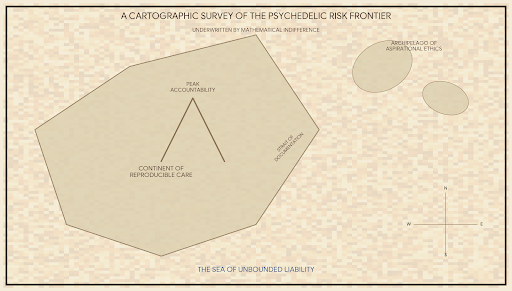

Here is the risk few are naming aloud.

If coverage arrives before standards, the result will not be access—it will be exploitation.

Commercialization without care invites volume over vigilance. It rewards speed over skill. It turns complex human experiences into billable events before the ethical scaffolding is complete.

We have seen this movie before in healthcare. Early enthusiasm followed by rapid scaling, followed by harm, followed by regulatory backlash. Once trust is broken, it is extraordinarily difficult to rebuild.

The irony is painful: the very coverage advocates are pushing for could, if rushed, destroy the thing they are trying to protect.

This Is a Leadership Moment

This is not just an insurance question. It is a leadership test.

Do we build the container before we pour into it?

Do we insist on discipline before demand?

Do we protect patients even when the market is impatient?

The temptation is understandable. Billability signals legitimacy. Reimbursement unlocks scale. But scale without integrity is not progress—it is erosion.

“If it becomes billable before it becomes ethical, we lose.”

Not metaphorically. Systemically.

A Call to Action: Preconditions, Not Permission

The path forward is not obstruction. It is sequencing.

Coverage should be the result of readiness, not the catalyst for it.

That means leaders—clinical, operational, and policy—must align around clear prerequisites:

· National or regional credentialing standards

· Defined scopes of practice and supervision models

· Mandatory adverse event reporting

· Outcome frameworks tied to patient and system value

· Integration requirements with existing care teams

These are not barriers. They are bridges.

Insurers will move when they see seriousness. Health systems will follow when risk is shared responsibly. And patients will benefit when care is delivered inside structures designed to protect them.

2026 is coming whether we are ready or not.

The question is not whether coverage will arrive—but what it will land on when it does.

Onward.

ABOUT THE AUTHOR

Silent

Silent provides the tools for seekers to recognize their path and enables self-reliance for spiritual and magickal growth.

Seekers gain insight from his work and find their inner calm from his ability to listen and help others reflect.