Silent

Silent provides the tools for seekers to recognize their path and enables self-reliance for spiritual and magickal growth.

Seekers gain insight from his work and find their inner calm from his ability to listen and help others reflect.

Insurance Will Decide What Ethics Could Not

Tone at the Top

There is a quiet but decisive force shaping the future of psychedelic medicine, and it is not regulators, ethicists, or even clinicians.

It is insurers.

For the last decade, the psychedelic field has leaned heavily on ethics statements, professional manifestos, and aspirational codes of conduct. These were necessary. They were also insufficient. Ethics without enforcement are values without leverage. And leverage, in modern healthcare, comes from risk underwriting.

Insurers do not care how inspired your mission statement is. They care whether your outcomes are defensible, your processes repeatable, and your exposure containable. Where the industry hesitated to self-regulate with rigor, insurers will now impose standards with mathematical indifference.

They will not be gentle.

1. Outcome Accountability Is No Longer Optional

The psychedelic sector has relied on narrative outcomes for too long. “Transformational experiences.” “Breakthrough healing.” “Deep personal insight.” These may resonate culturally, but they fail actuarially.

Insurers price risk, not intention.

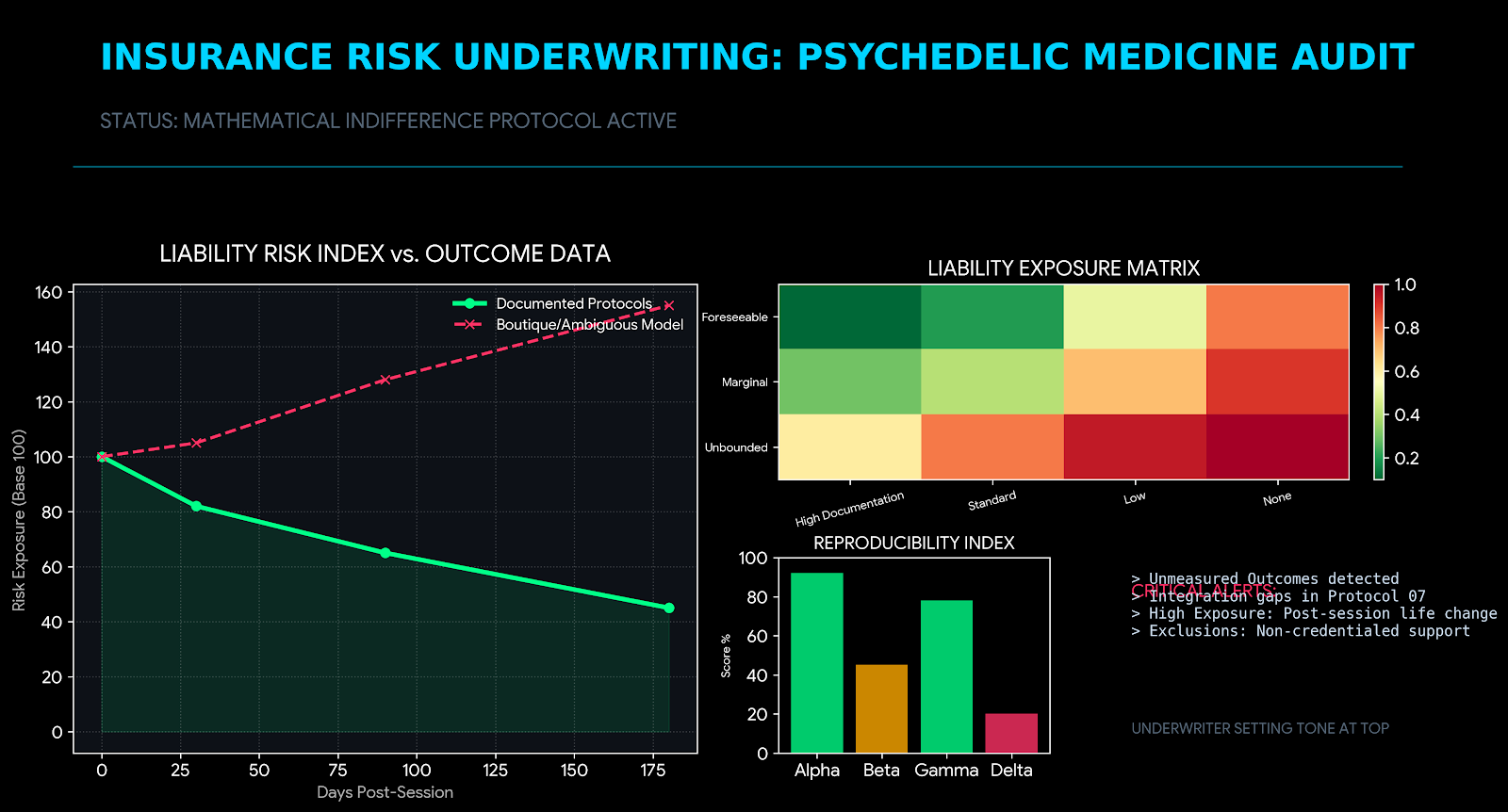

Underwriting models are already shifting toward outcome accountability—measurable, longitudinal, and comparative. This does not mean every patient must improve. It means you must be able to demonstrate how improvement is defined, tracked, and contextualized against known risk factors.

Expect questions like:

· How do you define a successful outcome at 30, 90, and 180 days?

· What percentage of patients show symptom regression?

· How are adverse psychological responses documented and escalated?

· What is your protocol when integration fails?

If your answers rely on practitioner intuition rather than documented pathways, coverage will narrow—or disappear entirely.

The uncomfortable truth: insurers are becoming the de facto outcomes review board. Not because they want to shape consciousness, but because unmeasured outcomes create unbounded liability.

2. Documentation and Reproducibility Will Be the New Gatekeepers

Psychedelic practice has celebrated the uniqueness of each journey. Insurers will tolerate that only up to the point where uniqueness becomes non-reproducibility.

From an underwriting perspective, variability without structure is indistinguishable from negligence.

Documentation requirements are already tightening:

· Session preparation protocols

· In-session monitoring records

· Post-session integration notes

· Referral and escalation criteria

· Informed consent specificity (especially around non-ordinary states)

Reproducibility does not mean standardizing the experience. It means standardizing the safeguards.

Insurers are asking a simple question: If two different clinicians follow your model, will they make materially similar decisions when something goes wrong?

If the answer is no, premiums rise. If the answer remains no, exclusions appear.

This is where many well-meaning clinics will stumble. They confuse practitioner freedom with operational ambiguity. Insurers will not.

3. Liability Exposure Scenarios Are Expanding—Not Shrinking

Much of the industry’s risk modeling remains stuck on acute harm: bad trips, boundary violations, or improper dosing. Insurers are already looking further downstream.

Consider the emerging liability scenarios:

· A client makes a major life decision post-session and later alleges undue influence.

· A pre-existing dissociative condition is exacerbated despite screening.

· A client discontinues psychiatric medication without medical coordination.

· Integration support is insufficient, leading to functional impairment months later.

· A clinician deviates from protocol under perceived “intuitive necessity.”

Each of these scenarios is survivable—if you can show that your system anticipated them.

Liability does not hinge on whether harm occurred. It hinges on whether harm was foreseeable and whether reasonable safeguards were in place.

This is where insurers become unforgiving. Not because they are hostile to psychedelic work, but because ambiguity is expensive.

4. Why Insurers Care More About Integration Than Ideology

Here is the paradox the industry has not fully grasped: insurers are less concerned with the psychedelic session itself than with what happens after.

Integration is where risk lives.

From an insurer’s point of view, the altered state is time-bound. Integration is indefinite. It is where meaning-making intersects with behavior, relationships, employment, and identity. It is where claims emerge.

This is why underwriters are increasingly focused on questions such as:

· Who provides integration, and with what credentials?

· How long does integration support last?

· What happens when integration reveals trauma beyond scope?

· How are clients transitioned back to primary care or mental health services?

· What documentation exists to show continuity of care?

Ideology—whether spiritual, therapeutic, or transformational—does not mitigate risk. Structure does.

Insurers are effectively saying: Believe whatever you want. Just show us how you prevent people from unraveling afterward.

This is not an attack on meaning. It is an insistence on containment.

5. The Strategic Miscalculation the Industry Is Making

Many psychedelic organizations assume that insurance pressure will slow the field. The opposite is more likely.

Insurance standards will separate scalable models from boutique practices. Those who prepare will gain access to broader markets, institutional partners, and eventually public trust. Those who resist will be confined to the margins, regardless of their ethical purity.

This is not a moral judgment. It is a market reality.

Healthcare systems expand through risk transfer. If risk cannot be priced, it cannot be scaled. If it cannot be scaled, it will remain niche.

The industry’s mistake is framing insurance as an external imposition rather than an internal mirror. Insurers are simply quantifying what the field has been reluctant to formalize.

6. Call to Action

Prepare for underwriting questions now, or answer to exclusions later.

This means:

· Auditing your outcome definitions

· Formalizing integration pathways

· Stress-testing your documentation

· Clarifying scope-of-practice boundaries

· Designing for reproducibility, not mystique

Insurance will decide what ethics could not—not because ethics failed, but because ethics without infrastructure cannot carry risk.

The future of psychedelic medicine will not be determined by who speaks most eloquently about transformation, but by who can demonstrate responsibility under pressure.

Tone at the top matters.

And right now, the tone is being set by underwriters.

ABOUT THE AUTHOR

Silent

Silent provides the tools for seekers to recognize their path and enables self-reliance for spiritual and magickal growth.

Seekers gain insight from his work and find their inner calm from his ability to listen and help others reflect.